The shift from fee-for-service to value-based care is creating new market opportunities and major healthcare organizations are seizing those opportunities. In a previous article, we discussed the market implications of the CVS-Aetna merger. This merger promises to be one of many as healthcare organizations scramble to align organizational priorities with the shift to value-based care.

CVS Health's $69 billion deal to acquire insurer Aetna aims to reshape basic health care as the combined company seeks to bolster its prescription drug business while nudging customers away from costly emergency room visits and toward affordable clinical care for routine ailments at the drug store. While some view the merger as a preemptive strike to Amazon entering healthcare, others view the possibility of growing the Minute Clinic to offer more medical services. "What Aetna customers are likely to see early on are more plans designed to drive them to CVS for not just their prescription drugs, whether it’s mail-order or in the store, but also for their medical care," said Marianne Udow-Phillips, executive director of the Center for Healthcare Research & Transformation at the University of Michigan.

Now we are learning of another merger in which Humana would acquire Kindred Healthcare. Kindred Healthcare is the largest provider of home healthcare and hospice services in the United States. To become the largest provider of home health and hospice services, Kindred acquired Gentiva Health Services Inc. in 2015 for $1.8 billion, turning it into the biggest U.S. provider of home health and hospice care, but also saddling it with debt.

The CEOs of both organizations say that this merger aims to change how care is delivered in the home. From Humana’s perspective, this merger aligns nicely with its Medicare Advantage strategy. According to the third quarter earnings report, Humana currently has 2.8 million people enrolled in its Medicare Advantage plan.

Broussard also said that the Humana-Kindred combination would allow the companies to take greater advantage of technological advances, including telehealth and remote monitoring, which would allow medical professionals to intervene sooner and prevent or delay more serious health problems. While the idea of expanding technological care into the home health space will allow patients to be better monitored in the home, setting up systems to incorporate the voice-of-the-patient into this care will have to be in place to measure the success of these programs.

The combination of Humana and Kindred would allow the companies to work together to optimize the work flow and use of data to provide patients with a more efficient and simpler experience as they’re recovering after acute treatments, Broussard said. With the aim of creating a more efficient, simpler experience for the patient, having strategic listening posts in place to capture the voice-of-the-patient in these remote settings will offer real-time, actionable patient feedback to iterate and innovate around the patient experience.

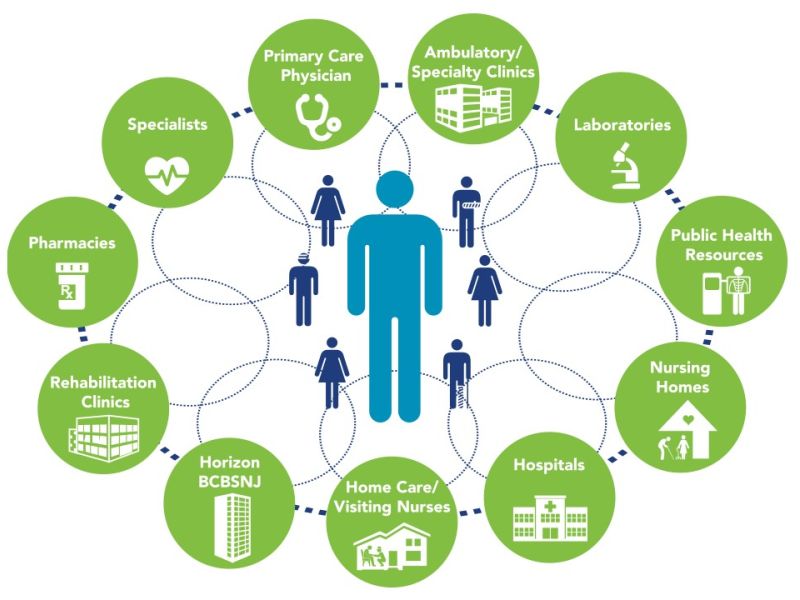

“Interwoven with our provider strategy, we continue to be very focused on the home, as home is often a superior clinical environment to deliver care and reduce high-cost hospital admissions,” Humana CEO Bruce Broussard told analyst last month on the company’s third quarter earnings call. “In its current state, care in the home is often disconnected from primary care physicians, challenged with issues on timeliness of care, lacking in robust data exchange, as well as based on a Fee-for-Service-driven business model.”

Patient feedback systems, like CRMD, can map the patient journey across the continuum of care helping bridge the disconnect from hospital to the physician office to Minute Clinics to homecare.